Tradezella Alternative

(2026 edition)

Essential features for less

Feature Comparison

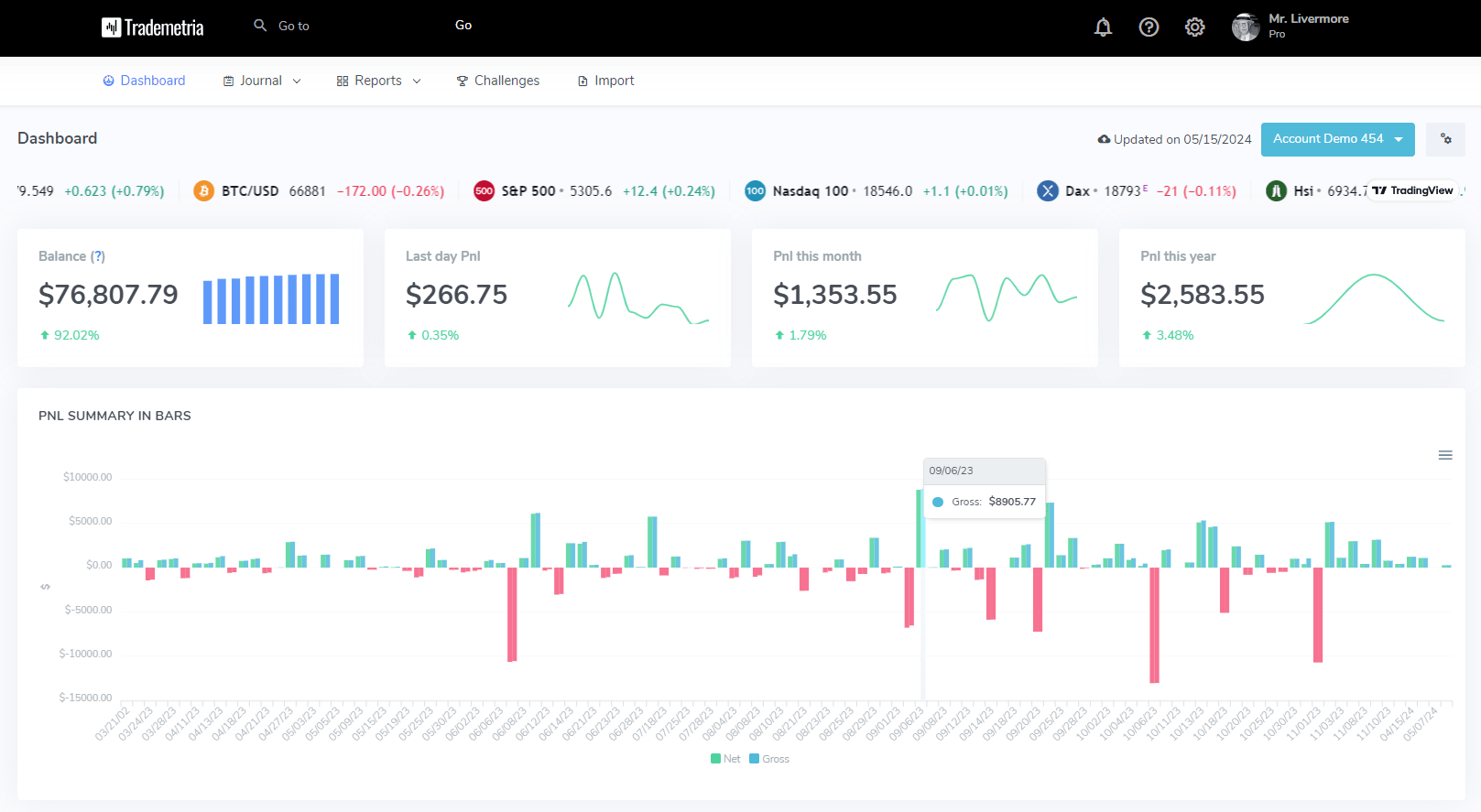

When it comes to trading journals and analytics platforms, two names often come up: Trademetria and TradeZella. Both tools offer robust features for traders looking to analyze their performance and improve their strategies. Choosing one over another really depends on your trading style and needs. Our review is based off of information on Tradezella's website. This is a "best of our knowledge review" that compares key features between these two products.

|

Features

|

Trademetria

|

Tradezella

|

|---|---|---|

| Track dividends and cash transactions | Yes | No |

| Portfolio Tracker | Yes | No |

| Multi-currency accounts | Yes | No |

| Create your own challenges | Yes | No |

| Options spread reports | Yes | No |

| Simulator based on past trades | Yes | No |

| Goal Tracking | Yes | No |

| Free plan | Yes | No |

| Support all asset classes | Yes | No |

| Mobile app | No | No |

| Mentor Features | No (coming soon) | Yes |

| Trade via Simulator | No | Yes |

| Online training | No | Yes |

| Price | $249/yr | $399/yr |

Why Choose Trademetria Over TradeZella?

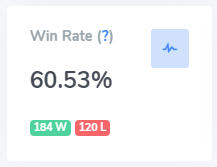

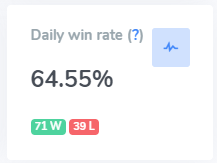

Trademetria stands out as the superior choice for traders who value simplicity, accessibility, and foundational analysis without the high cost and complexity of advanced tools. It provides robust trade tracking, performance analysis, and broker integrations across stocks, options, forex, and crypto within an intuitive interface, making it ideal for beginners or those seeking efficient, budget-friendly trade logging. While TradeZella offers more advanced features like trade replay and backtesting, Trademetria's straightforward approach and lower price point (including a free tier) mean you get essential functionality that helps you effectively manage your trading journey right away.

Don't miss out on what thousands of traders worldwide are using to improve their futures trading performance.

See Pricing Get a free account