How a Renowned Scientist Lost a Fortune in the Stock Market

By the early 1700s, Isaac Newton was more than just a scientific icon. His name carried weight not only in academia but also in the buzzing financial circles of London. Known worldwide as the genius who explained gravity and revolutionized mathematics, Newton also dabbled in investing — and like many of his era, he was drawn to the rising star of the markets: the South Sea Company.

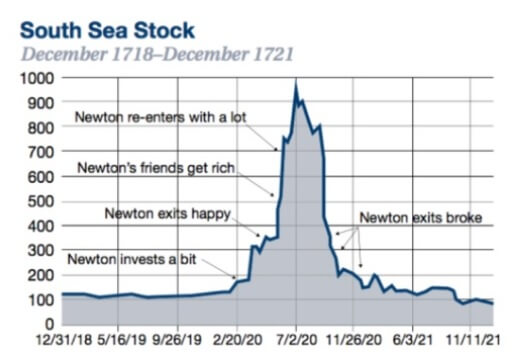

The company, granted a monopoly over trade with Spain’s colonies in South America, was the darling of the financial world. Expectations of staggering profits fueled a frenzy, and shares became the hottest ticket in town. Newton, analytical as ever, couldn’t resist the excitement. In 1720, he invested a large portion of his fortune, convinced the numbers — and the story — made sense.

The Bubble Bursts

But markets have a way of humbling even the sharpest minds. The euphoria around the South Sea Company morphed into one of history’s most infamous speculative bubbles. Prices soared to irrational heights, and when reality caught up, the collapse was swift and brutal.

Newton was among the casualties. Estimates suggest he lost more than £20,000 — a staggering sum at the time, equivalent to millions today. The financial hit was not just painful, but also a personal humiliation for a man whose intellect was revered across Europe.

It was in the wake of this disaster that Newton reportedly uttered his famous lament:

“I can calculate the motions of heavenly bodies, but not the madness of people.”

Lessons Beyond Numbers

Despite his losses, Newton’s fortune didn’t vanish entirely. He still held prestigious roles, including Master of the Royal Mint, which secured him a steady income. His scientific contributions remained untouched, but his experience in finance serves as a timeless cautionary tale.

The South Sea debacle revealed an essential truth: markets are not governed by pure logic, but by human psychology — fear, greed, and the herd mentality. Even the greatest analytical minds can fall prey to speculation when emotions take over.

Why It Still Matters

Newton’s story reminds investors today that:

Brilliance doesn’t protect against bias. Expertise in one domain doesn’t guarantee success in another.

Markets are driven by human behavior. Irrationality, not fundamentals, often moves prices in the short term.

Discipline beats euphoria. Knowing when not to chase the crowd can be more valuable than any equation.