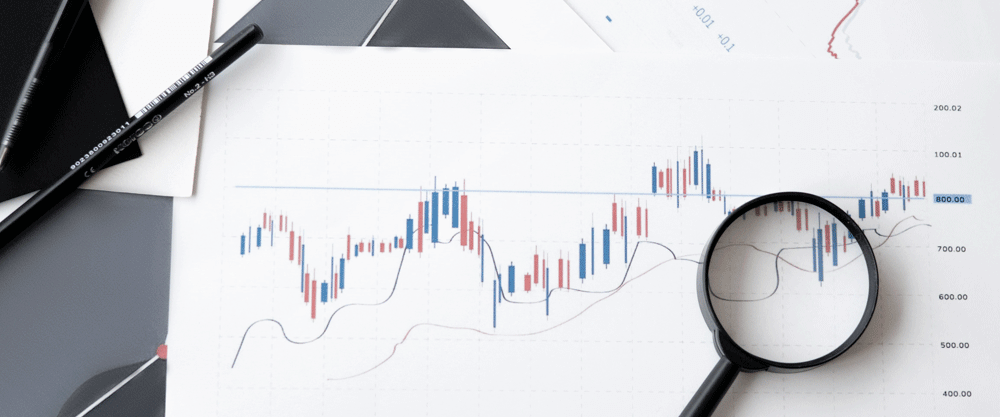

Beware of traders who say their win rate is x or y% because win rate doesn’t give a complete picture of someone’s trading performance…at all. Win rate is simply the percentage of trades that net gains. On the other hand, expectancy takes into account the average size of gains and losses giving you a better picture of a trader’s performance. In this post, we’ll explain both metrics and why they matter in understanding how good a trading strategy really is.